In collaboration with CCW Global

If you’re doing business in Hong Kong, it can sometimes feel like there’s a million different risks that your company is exposed to. From mandatory Employees Compensation Insurance through to more esoteric perils, like malpractice, cyber, and even Directors & Officers cover, there are a lot of bases to cover to ensure that you have all the protection you may need. So, what insurance should a professional or service-based company in Hong Kong be thinking about in the modern world?

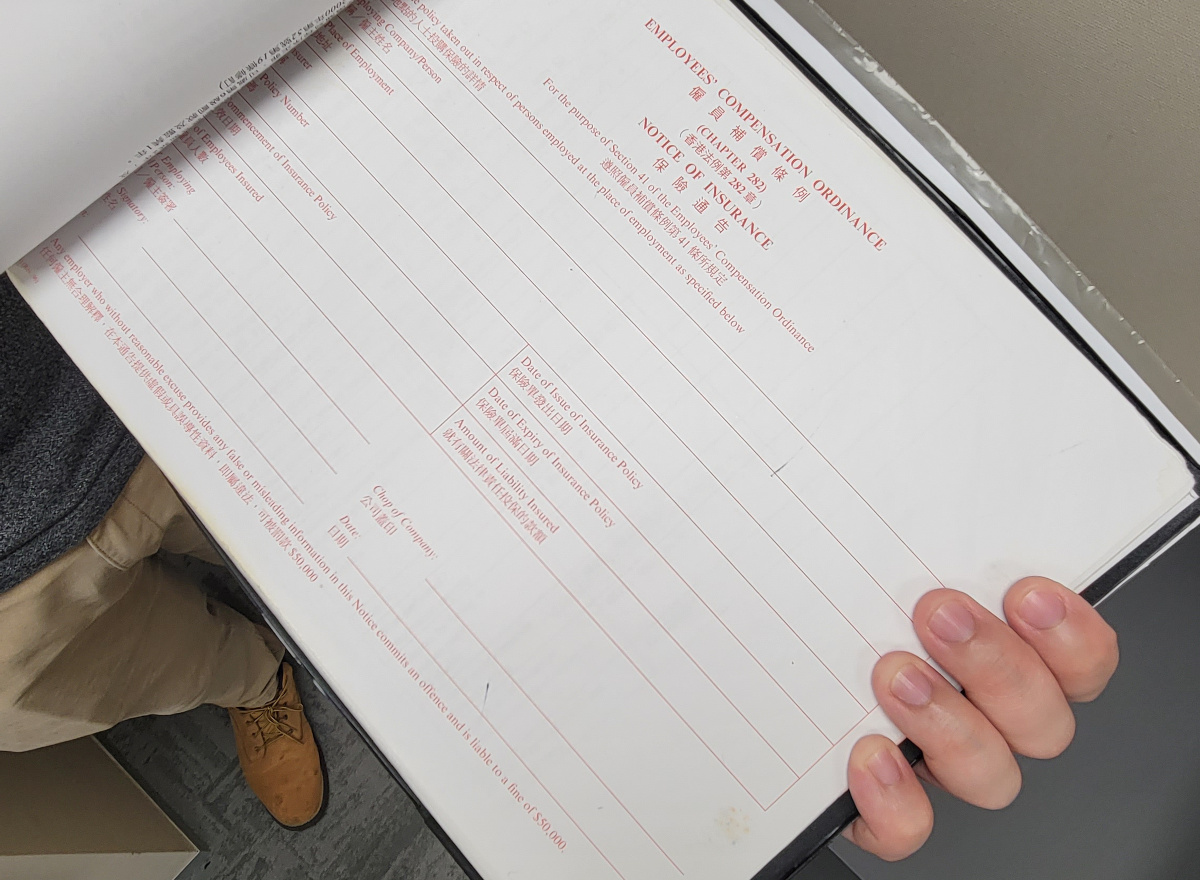

Employees’ Compensation Insurance

An obvious place to start is the only mandatory form of insurance required by every single employer in Hong Kong, Employees’ Compensation Insurance. If you’re employing anyone to do any job in Hong Kong, then by law you are required to have an insurance policy covering your liability of that worker suffering an accident or injury in the routine course of their employment.

EC Insurance protection is held by every single company in the territory and can prove invaluable in the event of a claim. Regularly updating your EC coverage as your company grows can ensure that you don’t have any gaps in this form of protection, and if the Labour Department performs a surprise inspection, you should have no issues satisfying your statutory requirements.

Read More: All You Need To Know About Employee’s Compensation Insurance In Hong Kong

Professional Indemnity Insurance

Any business giving advice to any customer runs the risk that they could be accused of malfeasance, malpractice, or negligence. If the customer suffers a loss because of these accusations, and any of these accusations are found to be true, then the business could be liable for the losses.

Professional Indemnity insurance is also known as “malpractice insurance,” and covers your business and employees against their risk of making a mistake which materially impacts a customer. From law firms for getting to cross the T or dot the I on a contract, or financial services companies that carry the wrong number on a spreadsheet, simple mistakes can happen every single day.

Professional Indemnity insurance ensures your business is insulated when they occur.

Directors and Officers Insurance

Directors and Officers insurance, also known as “D&O Insurance,” is similar to professional Indemnity protection but is more focused towards coverage of the high-level Executives at a business; hence the name “directors and officers.”

This type of insurance is designed to protect your business should any of your company senior directors or officers be the recipient of a claim that they have acted in a wrongful manner. Under this type of policy, the definition of “wrongful act” is extremely broad and covers breaches of trust, omissions, misstatements, errors, defamation, breach of duty, and violations of the Sarbanes-Oxley Act of 2002 or equivalent laws.

Cyber and Digital Insurance Protection

Businesses are increasingly dependent on a raft of digital tools to accomplish their goals and service customers. But this dependence on connected devices in The Internet of Things, cloud-based servers, and software as a service means that companies of all types are far more vulnerable to the whims of Internet criminals than ever before.

Cyber Insurance products are designed to bring Industrial Age Insurance Solutions into the 21st century. They accomplished this by giving businesses a wide range of bespoke protection for all possible cyber risks present around the world. Whether you’re concerned about business Interruption because your CRM server goes down, or you have to spend money to repair your website after a vandalism event, each Cyber-Insurance product is created specifically for the business it is covering.

With the number of growing cyber-crime events increasing each and every year, this is a form of Professional Insurance that no business in Hong Kong can afford to go without.

Liability Insurance

It has never been easier to sell something online without actually manufacturing the physical product, but using an online platform to sell your goods comes with both risks and requirements. Big Ecommerce platforms are increasingly requiring sellers to have some form of liability coverage for the goods that they are providing online.

Commercial Goods liability insurance can protect both a vendor and an e-commerce platform against claims of defective or dangerous goods closing accidental injury or property damage. But even companies that don’t make anything and don’t deal with a physical product that’s bolt and sold need to have liability concerns present in their mind.

Public Liability insurance is designed to protect your business against physical damages which the company may have caused to third parties (either by way of bodily injury death or property damage). From the risk of a client coming into your office tripping over carpet and breaking their arm to your advertising hoarding falling down in the building Lobby and hitting a random passerby on the head, Liability Insurance is easily overlooked but is another product that can be invaluable when needed.

About CCW Global

CCW Global is an expert insurance broker in Hong Kong. Founded in 2012, we are dedicated to serving our clients across all their coverage needs and provide a no risk no obligation quotation service that ensures you only pay for the insurance you require.

CCW makes it easy to view personalized comparisons from different companies to help you make the best choice.

Header image credit: Canva

More about insurances in Hong Kong:

- The 3 Main Types Of Insurance Companies In Hong Kong (And Their Pros & Cons)

- All You Need To Know About Business Insurances in Hong Kong

- All You Need To Know About Employee’s Compensation Insurance In Hong Kong

- Critical Illness Insurance in Hong Kong : Are You Covered?

- Your Guide To Motor Insurances in Hong Kong

- All You Need To Know On Public Liability Insurance In Hong Kong

- Your Go-To Guide To Event Insurances In Hong Kong

- 3 Reasons To Get Insurance Before You Fly this Christmas

- Do I Need Health Insurance in Hong Kong?

- Home Insurance in Hong Kong: What you need to know

- The HK HUB Startup Insurance Guide